MIPLAN IP ENHANCED INCOME RETENTION FUND – QUESTIONS AND ANSWERS

Purpose of this Q&A

This Q&A is provided to help investors understand the specifics of the MiPlan IP Enhanced Income Retention Fund (“the Retention Fund”). Further information will be added hereto from time to time as and when such information becomes available. As such, this Q&A must not be considered as exhaustive.

If investors have further questions or require additional information, they are urged to contact their financial advisor, MiPlan or the IPMC Client Services Team on the respective contact details below.

Important Notice

IPMC and MiPlan are not privy to any information regarding Martius (RF) Limited (“Martius”), Redink Rentals (RF) Limited (“Redink”) or Bridge Taxi Finance Proprietary Limited (“BTF”) that is not published by those entities, or in the public domain.

All information regarding Martius, Redink and BTF has been obtained through the internet or from Vunani Fund Managers Proprietary Limited (“Vunani”).

Respective Entities

MiPlan established the MiPlan IP Enhanced Income Fund, providing it with its name and initial capital (“Main Fund”).

IPMC is the manager of the Collective Investment Scheme, including the Main Fund.

Vunani is the investment manager of the Main Fund.

Rowan Williams-Short of Vunani is the portfolio manager of the Main Fund.

Martius is a ring-fenced special purpose vehicle, incorporated for the sole purpose of holding and issuing notes to secured creditors under its Issuer Programme to fund the acquisition of and/or investment in participating assets in respect of a transaction.

Redink is a remote special purpose vehicle, with restricted operating activities, incorporated to purchase eligible assets with funds raised directly through the issuance of debt instruments.

BTF operates in the commuter sector, acquiring and/or importing minibus taxis, which it then sells under instalment sale agreements to taxi operators.

Redinc Capital Proprietary Limited is the arranger for each of Martius and Redink notes issues.

Which assets were side-pocketed?

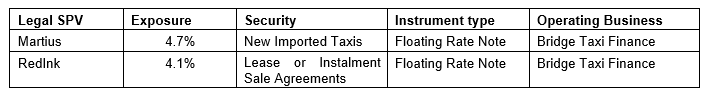

The Main Fund invested in two notes issued by Martius, namely the MAR02B, issued 23/09/2022, and the MAR03B, issued17/03/2023, and two notes issued by Redink, namely RED706, issued 17/04/2023, and RED707, issued 17/04/2023. These are the assets that were side-pocketed. Martius and RedInk are two separate legal entities, each with specific assets backing each of their structures. The common factor across both special purpose vehicles is the underlying business operation of BTF. The table below summarises the side-pocketed assets:

What is the structure and nature of the transactions giving rise to the side-pocketed assets?

The structures are extremely complex, but can be summarised and simplified, for illustrative purposes, as follows:

Step One: Vunani, in its discretion, subscribes for the notes in Martius and Redink on behalf of and for the Main Fund.

Step Two: Funds obtained by Martius are used to import taxis. Funds obtained by Redink are used to buy taxis and then lease them.

What process was followed in making the investment?

The fixed interest team of Vunani, as investment manager, sourced, analysed, assessed and made the investment in accordance the Main Fund’s Deed and investment policy.

Why was the Retention Fund necessary?

As indicated in the Q&A explaining retention funds, where an asset cannot be valued accurately the risk arises that the price for subscriptions or redemptions will not be accurately reflected, potentially resulting in concentrative or dilutive effects for investors entering or exiting a fund.

A retention fund avoids the scenario in which remaining investors are further exposed to these assets when or if other investors redeem from a fund. In addition, it avoids new investors being exposed to these assets when their valuation is uncertain.

Accordingly, the creation of the Retention Fund was deemed necessary to protect both existing and new investors, in the Main Fund, as it addresses the uncertainty created by the publication of the two SENS Announcements regarding the assets which have been side-pocketed and are the subject of the Retention Fund, allowing the fund manager the required time to investigate the best course of action to preserve long term value, realise the side-pocketed assets or claim under any security, where applicable.

What event occurred to require that these assets be side-pocketed?

On 31 January 2024, each of Martius and Redink published a SENS announcement drawing the attention of the holders of the side-pocketed assets that an event of default had occurred under a Revolving Credit Facility Agreement and Revolving Loan Facility Agreement, respectively, as well as a service default in respect of their Servicing Agreements. Holders and potential investors were also advised to exercise caution when dealing in the side-pocketed assets.

It was further established that there had been only a partial settlement of interest owing to subordinated debt holders. A preliminary assessment by Vunani indicated that the credit risk of the business and its associated debt instruments had increased significantly and remained elevated.

According to Vunani’s preliminary investigation and assessment, the underlying cause of the defaults was, amongst others, increased consumer distress due to heightened interest rates and inflation, and the prevailing credit environment, which placed significant pressure on BTF’s clients and their ability to meet their debt obligations.

While Vunani has been in contact with BTF, other debtholders and shareholders, it is apparent that more time would be required to understand the challenges facing the BTF business, and the potential effects and consequences thereof on the side-pocketed assets.

As a result of this uncertainty it became necessary to be prudent and cautious, to protect the interests of both existing and new investors, especially given the lack of liquidity in trading and dealing in the side-pocketed assets.

When can investors redeem the side-pocketed assets?

Redemptions are not permitted from the Retention Fund until such time as the side-pocketed assets are able to be realised or their valuation confirmed. Although the instruments are still pricing in accordance with the normal process for listed instruments, the portfolio manager is of the view that:

– the valuation cannot currently be accurately determined; and

– the liquidity / tradability of the notes or side-pocketed assets is uncertain at this time.

The portfolio manager will continue to actively engage with the issuers, the underlying business, and other stakeholders, to establish the best course of action to support the business, in the interest of long-term value maximisation. There is no defined timeline at this stage.

Once the process is concluded, and dependant on the outcome, the Manager would likely collapse the Retention Fund and transfer the side-pocketed assets back to the Main Fund for the benefit of the investors in the Retention Fund or redeem the proceeds of the realised side-pocketed assets to the investors in the Retention Fund.

Contact details

IPMC Client Services Team : clientservices@ipmc.co.za / MiPlan : info@miplan.co.za.

To view a PDF version click here.